do nonprofits pay taxes on utilities

You pay use tax when the seller does not collect sales tax at the time of sale for example items purchased over the Internet and by mail order Use tax is paid on the Excise Tax Return or. Electric sector most public utlities are for-profit companies.

2 Companies Offering No Deposit Electricity In Baytown Tx 2020

Potentially your non-profit corporation could avoid paying corporate income taxes property taxes and state sales taxes in Massachusetts.

. It is important to contact each utility in. According to the Michigan tax code at the time of publication churches schools charities eligible hospitals and other nonprofit organizations are exempt from state sales tax on regulated electric natural gas and telecommunication bills. In fact the company.

Some have thousands of employees while others employ a couple of key people and rely on. To apply for federal tax exempt status click on our links below. Even though the federal government awards federal tax-exempt status a state can require additional documentation to.

Once a nonprofit has incorporated and received its tax exempt number it is automatically exempt from corporate income tax only. All other tax breaks and incentives including property tax have to be applied for individually. S346 would replace the nonprofit sales tax refund system with sales.

Failing to pay UBIT on debt-financed property or income from controlled organizations could have serious consequences ranging from taxes penalties and interest to the loss of your tax-exempt status. The Trust Fund Recovery Penalty TFRP may be assessed against any person including an officer director employee or a member of a board of trustees of a tax-exempt organization who is responsible for collecting or paying withheld income and employment taxes or for paying collected excise taxes and willfully fails to collect or pay them. Not the Only Tax-Exempt Entities Government entities also play a critical role in community well-being and also do not pay taxes on the government buildings owned and used by the 67 counties 500 school districts 2562.

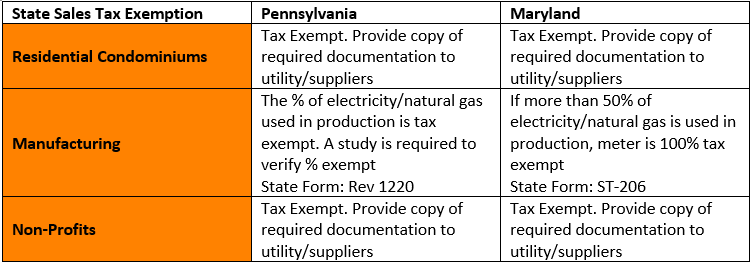

The exceptions are the big federal Power Authorities TVA Bonneville and the many smaller municipal and co-operative utilities. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. Many Pennsylvania-based nonprofits are not exempt from sales tax and thus pay a state sales tax on purchases made.

The research to determine whether or not sales tax is due lies with the nonprofit. Arkansas nonprofit corporations in Arkansas can apply for state corporate tax exemption by sending your articles of incorporation bylaws and a completed version of Form AR1023CT to the Corporation Income Tax Section of the Arkansas Department of Finance and Administration see the address and link below. The primary requirement however is first being granted federal tax exempt status by the Internal Revenue Service.

When nonprofit organizations engage in selling tangible personal property at retail they are required to comply with provisions of the Act relating to collection and remittance of the tax. Focusing on 501c3 entities for state sales tax Do nonprofits pay taxes. The one most universally recognized is 501c3 which is primarily related to religious charitable scientific and educational purposes.

Nonprofits are also exempt from paying sales tax and property tax. The state use tax is complementary to and mutually exclusive of the state sales tax. Under IRC 501c there are at least 29 different types of tax exempt organizations listed.

Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. But the money did not go to the government. However this corporate status does not automatically grant exemption from federal income tax.

Tax generally applies regardless of whether the items you sell or purchase are new used donated or homemade. These organizations are required to pay the tax on all purchases of tangible personal property. The IRS which regulates tax-exempt status allows a 501 c 3 nonprofit to pay reasonable salaries to officers employees or agents for services rendered to further the nonprofit corporations tax-exempt purposes.

Nonprofit organizations that receive an exemption identification number E number from the Department are exempt from state sales and use tax when purchasing tangible personal property in furtherance of their organizational purposes. While there is no general sales tax exclusion for nonprofit organizations certain types of organizations are eligible for specific tax exemptions and exclusions. Nonprofit organizations must pay sales tax to the seller at the time of purchase.

While the income of a nonprofit organization may not be subject to federal taxes nonprofit organizations do pay employee taxes. To be tax exempt most organizations must apply for recognition of. Four Tax-Free Fundraising Events a Year.

Individuals businesses and groups must pay use tax on their taxable purchases. Federal Tax Obligations of Non-Profit Corporations. A system of sales tax exemption would save nonprofits time and reduce administrative burdens.

Jen Solot a Tax Manager in our Not-For-Profit Group can help you understand if your nonprofit needs to pay UBIT. The four events. Nonprofit senior citizens groups can hold four tax-free sales events each calendar year.

Only incorporated nonprofits with IRS-issued tax exempt numbers can avoid paying taxes. Most nonprofits have paid staff. In addition to the monthly tax-free sale affiliated student organizations do not have to collect sales tax on the first 5000 of their taxable sales in a calendar year.

Pay to provide these nonprofits with public services like police and fire protection and street maintenance Gallagher 2002 33 For cities heavily reliant on the property tax the exemption of nonprofits from property taxation means that homeowners and busi-nesses must bear a greater share of the property tax burden. Answer 1 of 2. However organizations that have an E number are liable for excise taxes such as the Electricity Excise Tax the Gas.

This results in significant savings on monthly utility bills. Customers paid Xcel Energy a big utility in 10 Midwest and Western states at least 723 million to cover taxes from 2002 to 2004. Speaking just about the US.

Although many nonprofit and religious organizations are exempt from federal and state income tax there is no similar broad exemption from California sales and use tax. Many nonprofit and religious organizations are exempt from federal. Under current law charitable nonprofits in North Carolina pay sales and use tax on their purchases and can apply for semi-annual refunds of the taxes they pay.

Electric Utilities Sector Supplement Global Reporting Initiative

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

Free Cash Flow Forecast Templates Smartsheet Cash Flow Budget Forecasting Personal Finance Budget

Pdf Utility Solar Business Models Emerging Utility Strategies Innovation

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

Balance Sheet Definition Formula Examples

Lawrence Utilities Launches User Profile For Easier Web Payments

Providing Essential Utility Services During Covid 19 Payments And Relief

Readablebest Of Sales Tax Worksheet Salestaxbycity Salestaxdecalculator Salestaxharyana Budgeting Worksheets Budget Spreadsheet Budget Spreadsheet Template

Utility Payment Plans Utility Payments And Services Citybase

Call 211 Texas For Utility Assistance To Help You Pay The Light Bill

Tax Exemptions For Energy Nania

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Spreadsheet Template Cash Flow

Tax Exemptions For Energy Nania

Coronavirus Covid 19 Resources American Public Gas Association

Utility Users Tax Public Agency Accounts Spurr

Five Rules For Buying A House And How Far You Can Bend Them Buying A New Home Life Hacks Home Improvement